On 20 April 2022, the Brihanmumbai Electricity Supply and Transport undertaking (BEST) launched its first digital bus which had a new “Tap-In and Tap-Out” system. This system is similar to London’s Oyster Card; the only difference is that in London you don’t have to tap out since there is a single fare structure on their routes. Out of curiosity I wanted to try this system since I have been thinking about this after BEST launched their conductor-less bus services.

On 3 May I went to Chhatrapati Shivaji Maharaj Terminus (CSMT) and took A-115 to Churchgate. When I reached Churchgate Station there were two Electric buses on A-112 (Ahilyabai Holkar Chowk, Churchgate to Gateway of India) but since both buses didn’t have the tap-in/tap-out machines, I skipped both buses and waited for 10 -15 minutes. Then came a CNG Midi bus from Mumbai Central Depot (7147) on the same route. It never came to mind that this bus is the bus I have been waiting for. So I thought I would go back to CSMT Bus Station after taking a short trip to Gateway Of India.

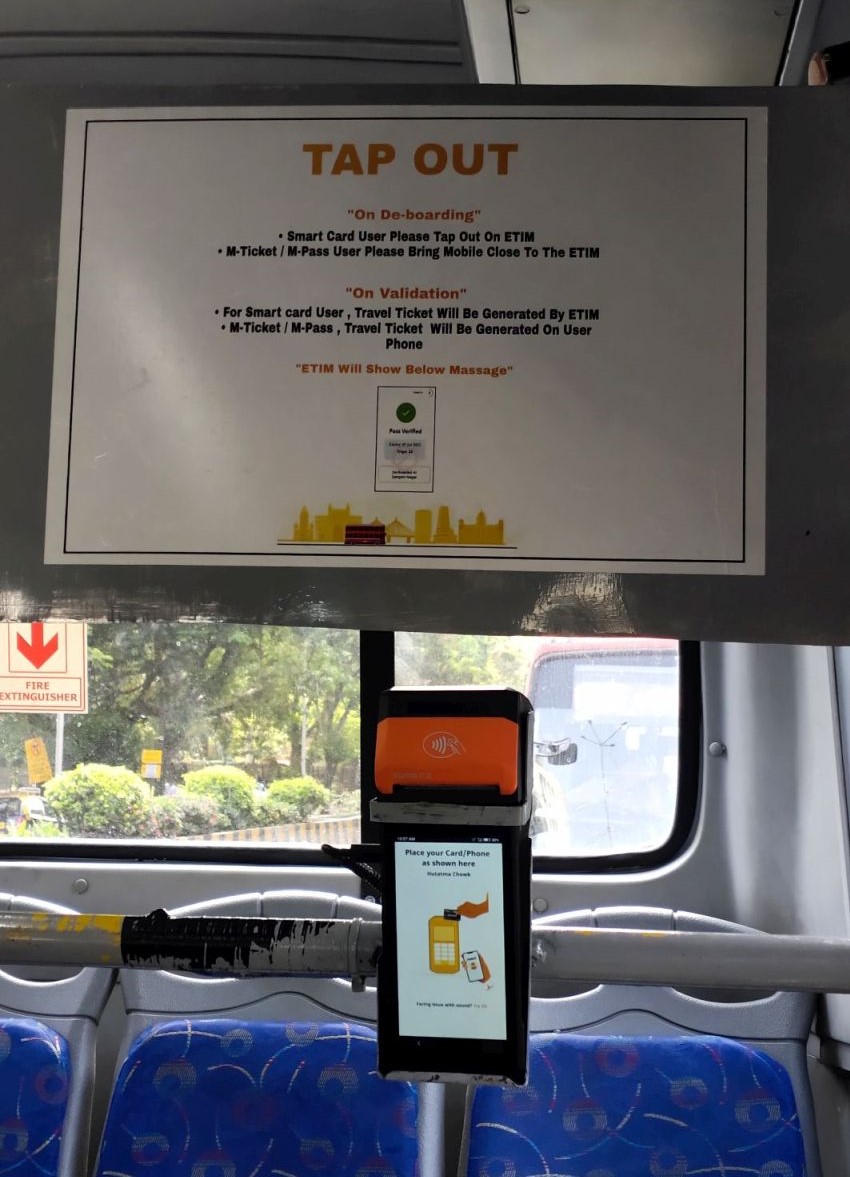

I bought a ticket from the ground booking conductor using an NCMC (National Common Mobility Card) and he was surprised to see it since for him it was first time seeing this new card. After telling him about how the card works after tapping it on ticket machine, I boarded the bus and after a few seconds I noticed that there were tap-in/tap-out machines installed at the front and rear doors respectively.

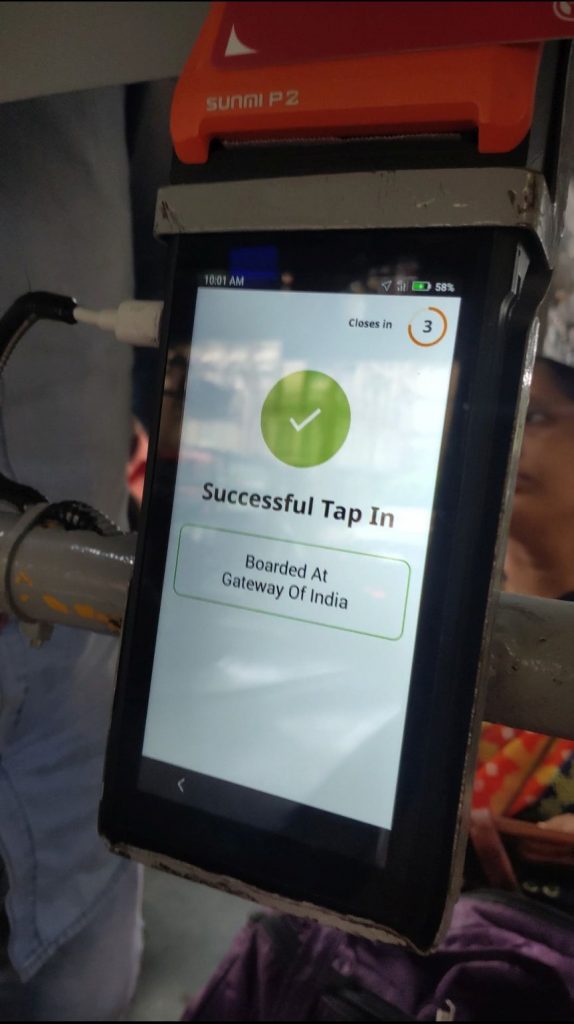

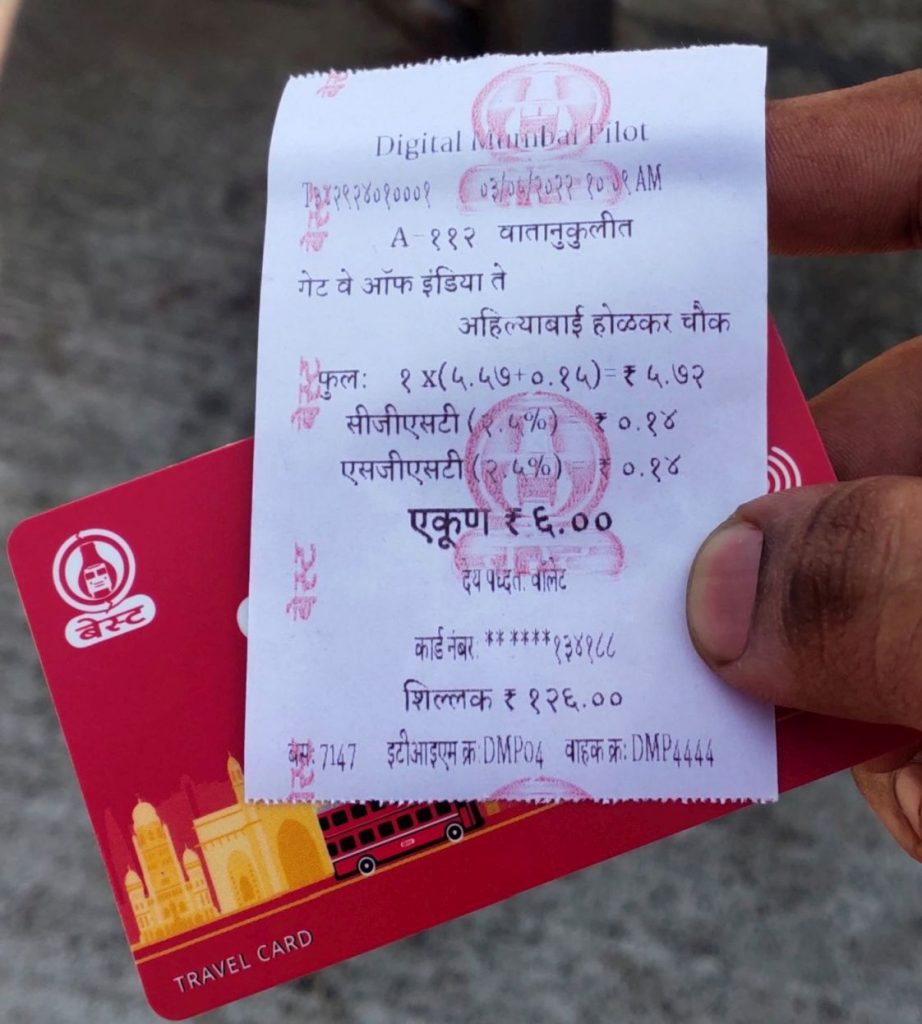

After the end of this trip, I boarded the bus again. I asked the conductor if I could use my card directly on the machines he agreed and at first my NCMC sadly didn’t work so next I used my normal Chalo Card, and it worked like a charm. There was a person who was monitoring this system inside the bus. I asked him why NCMC didn’t work, and he replied that they haven’t updated this system yet which is why my NCMC wasn’t being accepted by the machine. Finally at the end of the journey I had to tap out after that the fare amount was displayed along with the balance remaining in the card on the machine and I got a printed ticket.

Overall the system looks good, only one thing that should be skipped is printing paper tickets because at the end the machine displays remaining balance and the amount deducted for your card. The driver keeps a tab on commuters who are tapping in making sure that no one enters the bus without tapping in or having valid tickets. If a person forgets to tap out in the next tap In maximum fare will be deducted from his card balance. This system will get rid of those time consuming conductor-less services.

Before introducing more routes BEST should increase the sales of Chalo Smart card as well as Chalo NCM. It seems like very few NCMCshave been sold because every time I show mine to any conductor it is their first time seeing an NCM. Once Mumbai Metro and the Mumbai Suburban Railway integrate NCMC in their system commuters can easily change modes of transport without carrying multiple cards.

Featured Image: BEST’s Tap-In, Tap-Out system (Photo: Vishal Naik)

If you are stepping out, do note that while masks are no longer mandatory, the new XE variant of the Wuhan Virus is making the rounds. Stay safe, better safe than sorry.

![]()